Wake County Property Tax Rate 2024 Percentage Decrease – Wake County homeowners’ homes are expected to increase in value compared to 2020, but property taxes are not expected to jump as much as one might expect. . Wake County could see a decrease. Property owners will need to compare the percentage change of their property value to the average percentage change for Wake County overall. If county leaders .

Wake County Property Tax Rate 2024 Percentage Decrease

Source : www.wake.gov

Raleigh Downtown | Raleigh NC

Source : www.facebook.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

Wake County revaluation results: home, commercial values soar

Source : www.newsobserver.com

Wake County revaluations | Home, property assessments means

Source : abc11.com

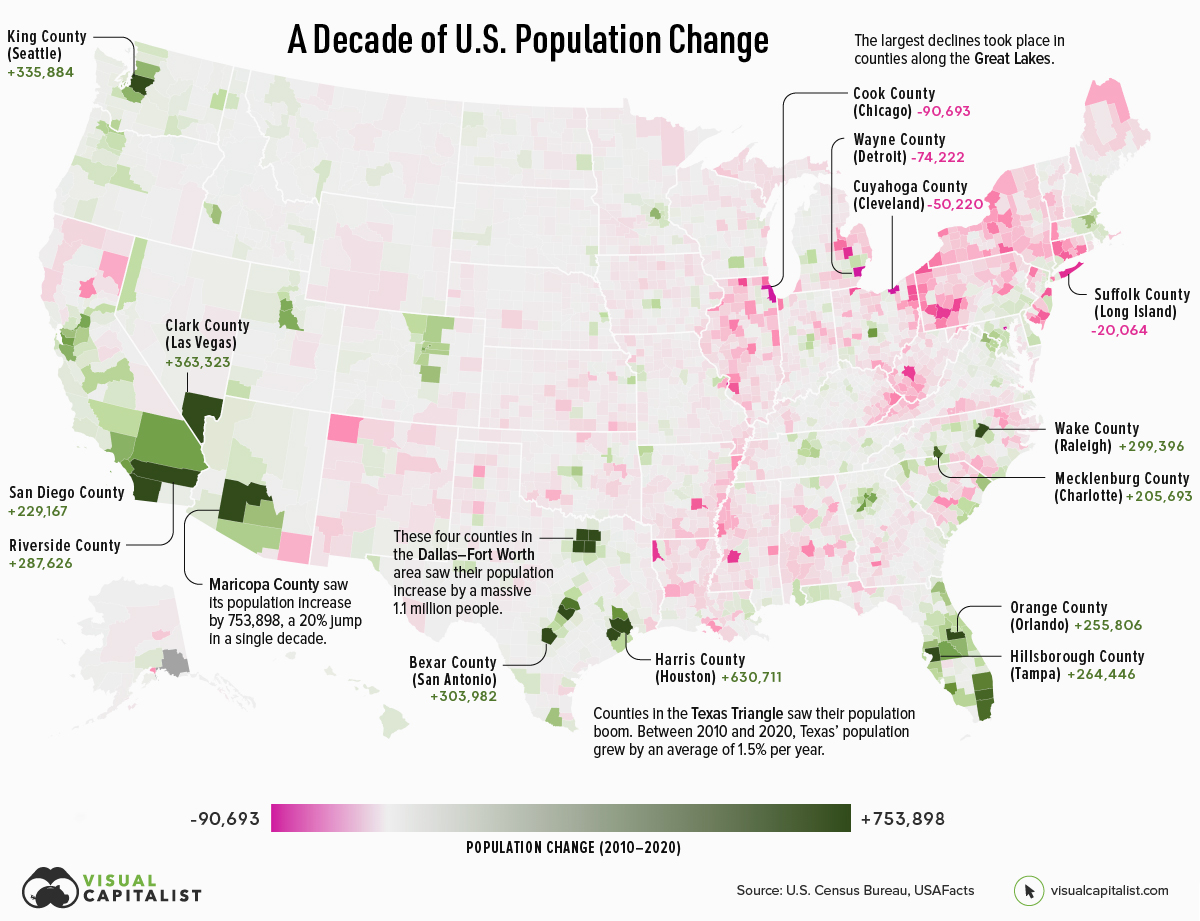

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

Wake County unveils $1.8 billion budget plan that includes

Source : abc11.com

New, higher Wake County property values are out this week. What

Source : www.yahoo.com

Wake County unveils $1.8 billion budget plan that includes

Source : abc11.com

Wake County Property Tax Rate 2024 Percentage Decrease Fiscal Year 2024 Adopted Budget | Wake County Government: July 1 is the deadline that Wake County Commissioners and municipal leaders must pass a budget with a new property tax rate. People can contact the Wake County Tax Administration with questions by . New property reassessments have increased the value of 53 percent of residential properties and 45 percent of commercial spaces. .